Average tax return for single

Whats the Average Tax Refund. Nearly 2402 million returns were filed in 2021 amounting to 7362 billion.

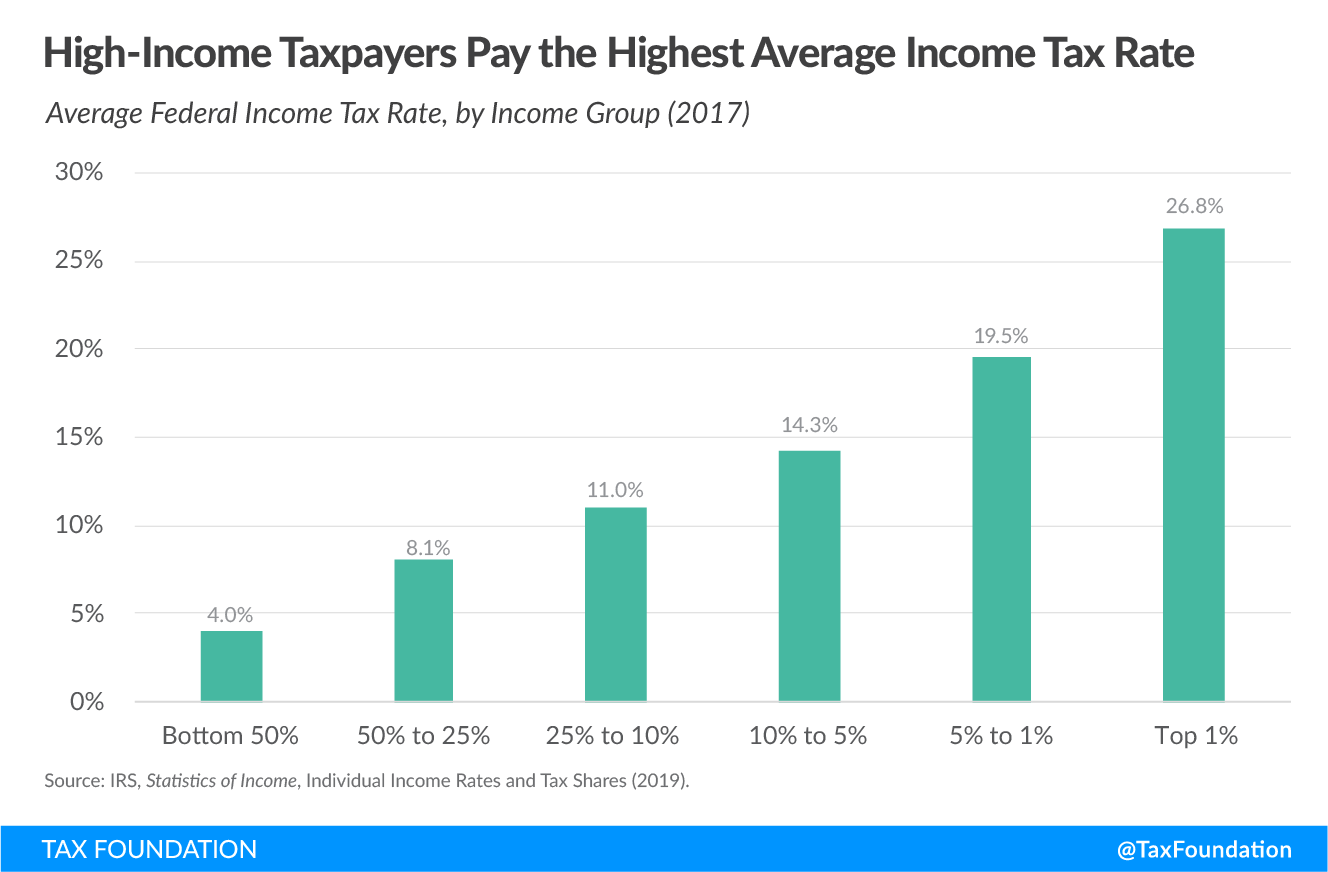

Average Tax Rate Definition Taxedu Tax Foundation

Whats the average tax return for a single person 2020.

. What is the average tax return for a single person making 65000. Your marital status is defined by your status on the last day of the tax year December 31. What is the average tax refund for a single person making 30000.

What is the average tax refund for a single person making 30000. 2 level 2 Op 2 yr. Those who have become legally divorced by December 31.

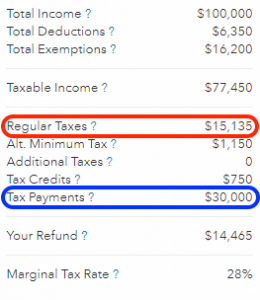

Based on our estimates using the 2017 tax brackets a single person making 30000 per year will get a refund of 1556. Those who have never married. This is based on the standard deduction of 6350 and a.

If you make 65000 a year living in the region of California USA you will be taxed 15631. Heres a look at the average tax refund issued by state for 2019 fiscal year listed from highest average refund amount to lowest. Amount of Internal Revenue Refunds Issued thousands of dollars for Individual Returns.

Free And Easy Tax Estimator Tool For Any Tax Form. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. In other words in the United States the take-home pay of an average single worker after tax and benefits was 776 of their gross wage compared with the OECD average of 752.

The average tax return for the 2020 tax year was 2827 a 1324 percent increase from the previous year. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. CNBC calculated those numbers by looking at the total number of refunds issued in.

Well the average tax refund is about 2781 According to Credit Karma. For the 2020 filing season which covers returns filed for the 2019 calendar year the average federal tax refund for individuals was 2707. Average Refund Issued Per Return.

In the United States the average single worker faced a net average tax rate of 224 in 2020 compared with the OECD average of 248. The average tax return for the 2020 tax year was 2827 a 1324 percent increase from the previous year. Those who are legally separated from a spouse.

Number of Individual Refunds Issued. You would claim the single filing status on your tax return if youre considered unmarried on that date. At the state level average income tax refunds ranged from a low of 2300 in Maine to a high of 3130 in Texas.

Ago Depends on your income and whether you have things like uni debt. Average Tax Refund by State. Ad Free Prep Print E-File Start Your Tax Filing Today.

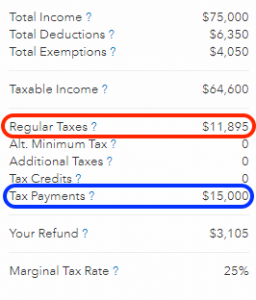

Last year he made 75000 withheld. Lets look at how to calculate the payroll deductions in the US. Discover Helpful Information And Resources On Taxes From AARP.

That means that your net pay will be 49369 per year or 4114 per month. So expect around three grand for your tax refund. There have been 1253 million refunds issued totaling 3177 billion.

John is a single 30-year-old with no dependents. Nearly 2402 million returns were filed in 2021 amounting to 7362 billion. The average tax refund.

What are the four tax brackets. An individual who receives 3203075 net salary after taxes is paid 4000000 salary per year after deducting State Tax Federal Tax Medicare and Social Security. How to calculate Tax Medicare and Social Security on a 4000000 salary.

But average doesnt mean guaranteed Theres nothing worse than planning for a refund and. Based on our estimates using the 2017 tax brackets a single person making 30000 per year will get a refund of 1556. 2 level 1 2 yr.

Ago Thats such a relief I think the 900 was just so high because it involved my last year of school and paying my loans off and all that as you mentioned. Mine usually range from between 300-600. This is based on the standard deduction of 6350 and a standard 30000 salary.

See How Easy It Really Is.

Effective Tax Rate Formula Calculator Excel Template

Tax Schedule

Average Tax Rate Definition Taxedu Tax Foundation

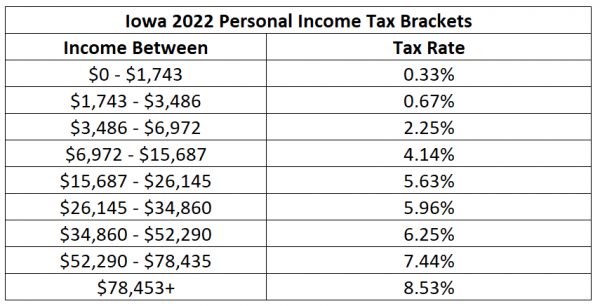

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Irs Form 433 B Oic Collection Information Statement For Businesses Visit Our Website To Download The Rest Of The Form Htt Irs Forms Sole Proprietorship Irs

What Are Marriage Penalties And Bonuses Tax Policy Center

Do I Need To File A Tax Return Forbes Advisor

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Rental Property Income Expense Tracker 5 Unit Single Family For Year End Tax Filing For Landlords Property Managers Digital Download Being A Landlord Rental Property Management Rental Income

Average Tax Refund May Surprise You

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Our Clients Have A Clear Advantage Because They Use Our Automatic Business Expense Mileage Tracker Simplif Tax Deadline Income Tax Preparation Tax Deductions

What Is 8 Form What Is 8 Form Is So Famous But Why Turbotax Income Tax Return Income Tax